Showing your company’s Internal Rate of Return (IRR) to investors when seeking funding is a great way to prove your company’s profitability and sustainability. There are many other ways to show profitability, like profit margins, ROIs, and the like, but if you are a startup that has just started, this might be hard to produce. It is why an IRR would be the next best thing.

What is IRR?

An IRR is a financial metric companies use to estimate how profitable a potential investment would be. Even when comparing different assets, the IRR calculation is an excellent tool as it is an ideal metric when analysing capital budget projects to understand and compare potential rates of annual returns over time.

Why is it important to know my IRR?

As a startup looking for funding, you may know that one of the challenges you would have to face when convincing investors to invest in your business is to show them that both you and them would make money in the end. Established companies can produce sales data, profits, and cash flow reports to prove that they can make money – but it’s a different story regarding startups.

Startups are usually new businesses with a somewhat untested product that they want to sell to a market. They may have some data they can show investors that could prove they have enough momentum to push them forward, but most investors need more than promises. This is why some startups would try to get venture capital investments to give them a chance, since these investors are willing to take on high-risk investments. We have a whole article dedicated to what startups need to know about venture capital if you want to learn more about them. But, even if they are high-risk investors, they still want to mitigate loss as much as possible —this is where your IRR comes in.

Typically, a high IRR would show investors that your company would have a chance to grow the money they invest in the project or company. The IRR your company would need to get investors interested would usually depend on what stage you are in your startup. For many early-stage companies, a 30% net IRR is the benchmark, while later-stage companies need around a 20% IRR over an average period of eight years. But, even if you hit these benchmarks, aiming higher gives you a better chance of getting chosen since you are not the only one seeking to get investors. If you want to explore options on how to boost your chances during the fundraising phase, hiring a fundraising consultant could be a huge help.

Related Reference: Should You Get Fundraising Consultants for Your Startup? Here’s How They Can Help

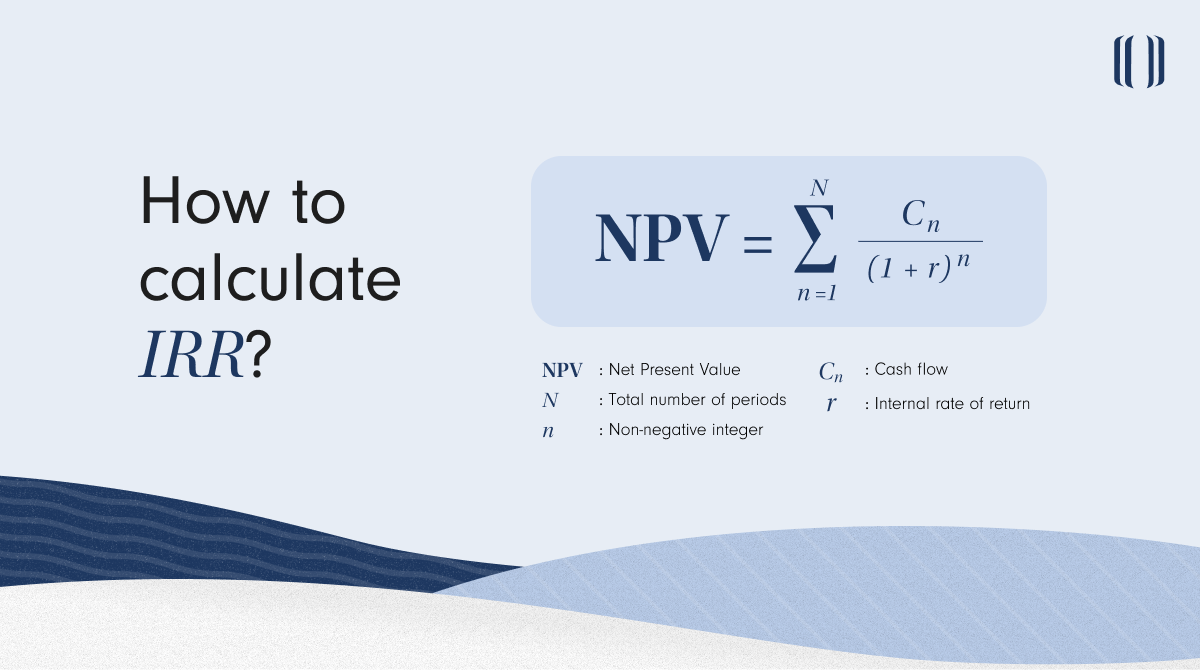

How to calculate IRR?

Although there is a formula for IRR, its complex nature makes manual calculations cumbersome. It would be better done through computer software primarily geared towards these things, or by searching for online IRR calculators. But if you were curious as to what the IRR formula looks like and how it works, here it is:

Where:

NPV is Net Present Value

N is total number of periods

n is non-negative integer

Cn is cash flow

r is internal rate of return

Source: Investopedia

Is there an easier way to do this?

As mentioned, there are tools that your company could use to calculate your IRR. A quick google search will show you many different online IRR calculators or even recommend articles on how to set up Microsoft Excel to do the calculations for you—but we understand that not everyone has the time to do it themselves.

To make things easier for you as a founder or administrator, getting a virtual VCFO can be a big help. A VCFO or Virtual Chief Financial Officer is someone who would manage your company’s cash flow and accounts. They not only help you with IRR calculations but also prevent poor financial management and spot issues that could cause poor cash flow in the long run. We have a more in-depth guide on how hiring a virtual CFO can make a critical difference in a downturn here if you want to learn more.

You could also avail yourself of online corporate secretaries like those at Lanturn. Corporate secretaries help streamline office tasks, help with accounting, stay on top of bookkeeping, and much more. If this is something you would like to explore, why not contact us today? Our team would be more than happy to help you get started!

If you want to learn more about us, follow our Facebook and LinkedIn pages.