FATCA Meaning

FATCA stands for the Foreign Account Tax Compliance Act, a U.S. law requiring foreign financial institutions to report U.S. taxpayers’ overseas accounts to the IRS. CRS, on the other hand, is a global OECD initiative where over 100 jurisdictions exchange financial account information to prevent tax evasion. In Singapore, IRAS enforces both FATCA and CRS, with financial institutions like banks, insurers, and fund managers required to file annual reports by 31st May. Non-compliance can lead to penalties and withholding taxes. Businesses should adopt strong compliance systems or seek expert help to stay fully aligned with reporting obligations.

What is FATCA? – Foreign Account Tax Compliance Act Explained

The Foreign Account Tax Compliance Act (FATCA) is a U.S. federal law enacted in 2010 that aims to combat offshore tax evasion by U.S. taxpayers. FATCA requires foreign financial institutions (FFIs) to identify, collect, and report information on accounts held by U.S. persons or entities with substantial U.S. ownership.

By doing so, FATCA ensures that the U.S. Internal Revenue Service (IRS) has complete visibility over overseas assets that may otherwise remain hidden from taxation.

For Singapore, this law is fundamental because the country is recognised as a global financial hub and one of the most conducive nations for conducting business.

Financial institutions operating in Singapore must comply with FATCA regulations if they have U.S. account holders or receive U.S.-sourced income. One of the easiest ways to evade taxes is to hoard money in offshore accounts.

Hence, this law is not optional. Failure to comply could result in punitive withholding taxes, thereby affecting both institutions and clients.

FFIs must withhold 30% of the specific payments to payees who are non-compliant with FATCA. Moreover, FFIs that don’t comply with FATCA will have to bear 30% withholding of their own from US-sourced income.

FATCA Singapore Regulations Overview

In May 2014, Singapore entered into a Model 1 Intergovernmental Agreement (IGA) with the U.S. Treasury. Under this arrangement, financial institutions in Singapore are required to collect FATCA-related data from their account holders and report it to the Inland Revenue Authority of Singapore (IRAS). IRAS then transmits this information to the U.S. IRS.

The FATCA obligations in Singapore cover a wide range of financial institutions, including:

- Banks

- Custodians

- Fund managers

- Insurance companies

- Trust companies

The goal is to create transparency around cross-border account transactions and discourage individuals from using Singapore to conceal U.S. income. The 2014 FATCA Model 1 IGA was applicable for relevant reporting years before 2021. Now, the 2018 reciprocal FATCA Model 1 IGA regulations are relevant for reporting years 2021 and beyond.

Who Enforces FATCA in Singapore?

The Inland Revenue Authority of Singapore (IRAS) enforces the Foreign Account Tax Compliance Act Singapore. It ensures that reporting financial institutions (RFIs) like banks, trusts, custodians, fund managers, and insurance companies meet the FATCA due diligence and reporting obligations.

Non-compliance may result in sanctions from IRAS as well as financial penalties imposed by the IRS, such as those discussed above.

Thus, businesses such as banks and providers of fund services in Singapore must set up robust compliance systems to ensure they can fulfil their reporting obligations on time.

What is CRS? – Common Reporting Standard Explained

The Common Reporting Standard (CRS) is a global initiative developed by the Organisation for Economic Co-operation and Development (OECD) in 2014. The CRS establishes an international framework for the exchange of financial account information between tax authorities of participating jurisdictions. Unlike FATCA, which is a U.S. law, CRS is a multilateral agreement designed to combat global tax evasion.

CRS requires financial institutions to collect information about account holders’ tax residency and report that information to their local tax authority. The authority then shares it with the relevant jurisdiction.

For example, if a French tax resident holds an account in Singapore, IRAS will share the account details with the French tax authority.

CRS Singapore Regulations Overview

Singapore implemented CRS in 2017, and the first exchange of data took place in 2018. CRS requires Singaporean financial institutions to:

- Identify account holders who are tax residents in other CRS jurisdictions.

- Collect and maintain records of tax residency information.

- Submit reports to IRAS, which shares them with the relevant authorities globally.

Currently, more than 100 jurisdictions participate in CRS, making it a comprehensive global system for financial transparency and the prevention of tax evasion.

CRS vs FATCA – Key Differences

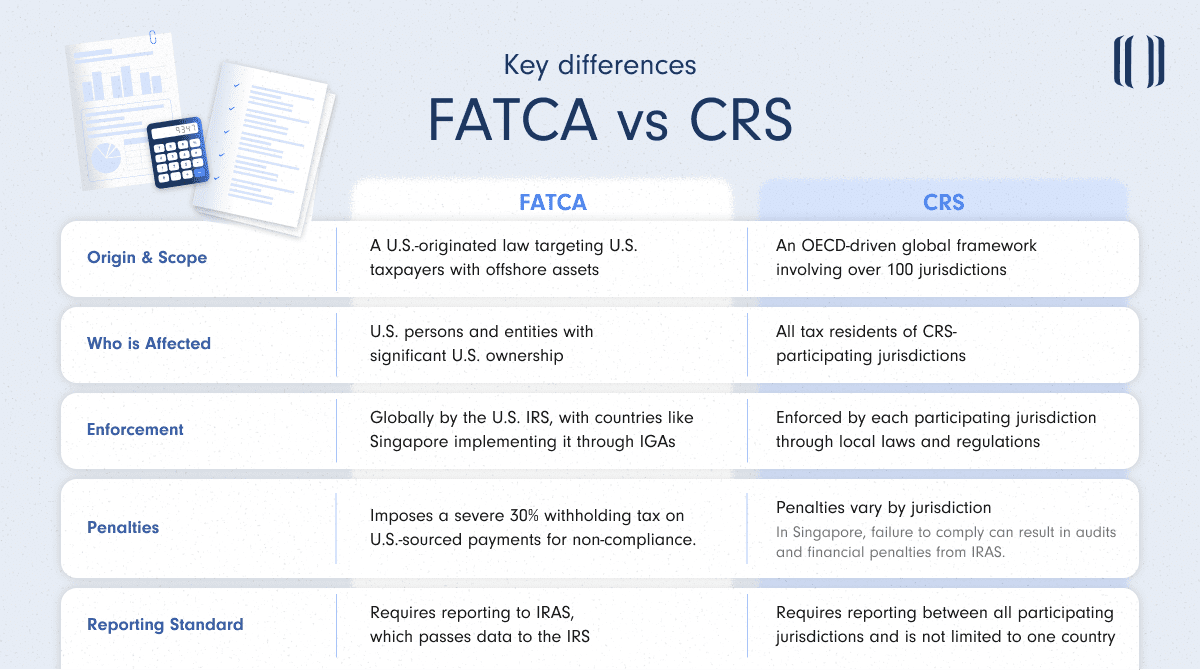

While both FATCA and CRS aim to curb tax evasion and increase transparency, there are several differences:

1. Origin and Scope

- FATCA is a U.S.-originated law targeting U.S. taxpayers with offshore assets.

- CRS is an OECD-driven global framework involving over 100 jurisdictions.

2. Who is Affected

- FATCA applies to U.S. persons and entities with significant U.S. ownership.

- CRS applies to all tax residents of CRS-participating jurisdictions.

3. Enforcement

- FATCA is enforced globally by the U.S. IRS, with countries like Singapore implementing it through IGAs.

- CRS is enforced by each participating jurisdiction through local laws and regulations.

Penalties

- FATCA imposes a severe 30% withholding tax on U.S.-sourced payments for non-compliance.

- CRS penalties vary by jurisdiction. In Singapore, failure to comply can result in audits and financial penalties from IRAS.

Reporting Standard

- FATCA requires reporting to IRAS, which passes data to the IRS.

- CRS requires reporting between all participating jurisdictions and is not limited to one country.

Overview of FATCA and CRS Regulations

Both FATCA and CRS play a crucial role in Singapore’s financial regulatory framework. As a leading international finance hub and one of the best-ranked places to conduct business, Singapore is committed to supporting global tax transparency.

Financial institutions in the country, including banks, insurers, custodians, and fund managers, must establish reporting mechanisms to identify and disclose reportable accounts. Even businesses undergoing company incorporation in Singapore need to develop compliance systems from the get-go if they plan to engage in financial services.

How to Fill the FATCA CRS Declaration Form for NRIs

For Non-Resident Indians (NRIs) with accounts in Singapore, filling out the FATCA CRS declaration form is a mandatory compliance step. Financial institutions use this form to determine the account holder’s tax residency and ensure compliance with both FATCA and CRS reporting obligations.

Required Information

The FATCA CRS Singapore declaration form typically requires:

- Full legal name

- Date and place of birth

- Current residential address

- Country (or countries) of tax residence

- Tax Identification Number (TIN)

- Account details

- Signed declaration

Step-by-Step Process

- Request the Form: Obtain the FATCA CRS declaration Form or Self-Certification Form from your bank or financial services provider.

- Provide Identification Details: Fill in your name, date of birth, nationality, and current residential address.

- Tax Residency Declaration: State all your tax residencies, basically any country where you are liable for tax.

- TIN Disclosure: Provide the relevant Tax Identification Numbers for each country of tax residence.

- Review and Sign: Carefully check all entries, sign the form, and submit it to the financial institution of the jurisdiction.

Common Mistakes to Avoid

- Leaving mandatory fields blank.

- Providing outdated or incorrect residential addresses.

- Forgetting to disclose dual or multiple tax residencies.

- Entering invalid TIN numbers.

- Failing to update the institution after a change in tax residency.

FATCA and CRS Compliance Best Practices for Businesses in Singapore

Singapore businesses that operate in the financial sector must establish strong internal compliance programs to meet FATCA and CRS obligations.

Internal Policies & Staff Training

- Develop formal compliance policies covering FATCA and CRS.

- Train employees to accurately collect customer data, spot reportable accounts, and not miss out on any compliance.

- Establish a compliance team or designate a FATCA/CRS officer.

Leveraging Technology for Reporting

- Deploy compliance software to automate account screening and reporting.

- Use secure data platforms to protect sensitive customer information.

- Integrate reporting tools that meet IRAS and OECD standards.

Who is affected by FATCA obligations?

FATCA obligations apply to:

- U.S. citizens and residents with accounts in Singapore.

- Entities with substantial U.S. ownership.

- Singapore-based financial institutions such as banks, insurers, trust companies, fund managers, and other service providers.

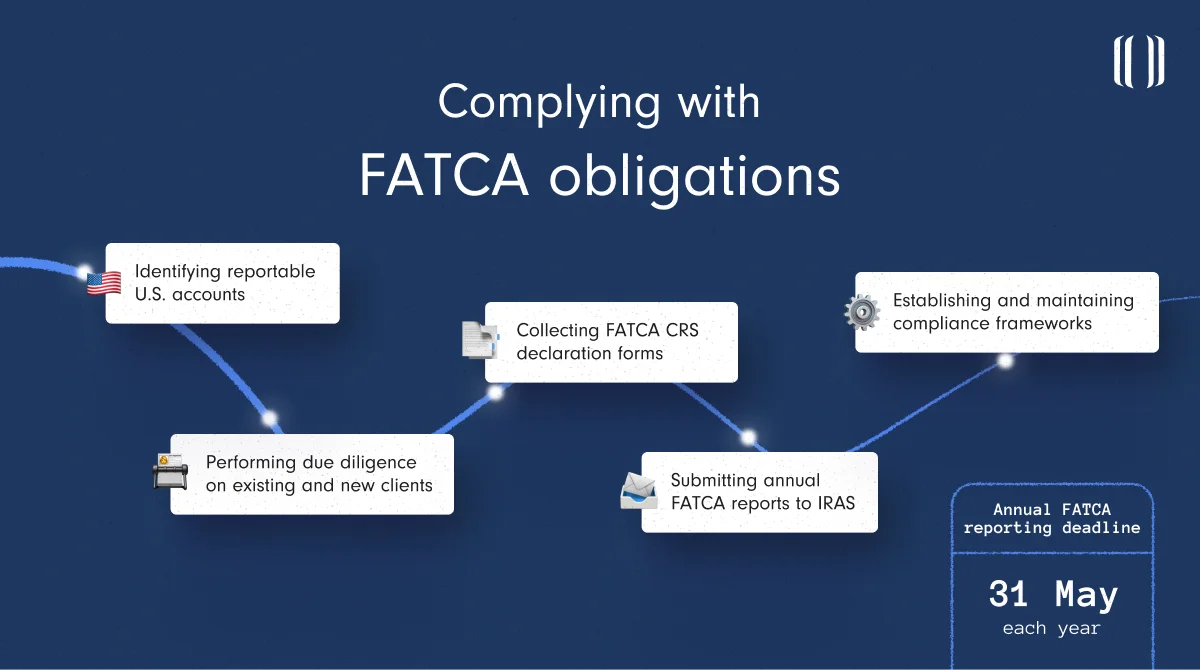

How do we comply with FATCA obligations?

Financial institutions in Singapore can comply with FATCA obligations by:

- Identifying reportable U.S. accounts.

- Performing due diligence on existing and new clients.

- Collecting FATCA CRS declaration forms.

- Submitting annual FATCA reports to IRAS.

- Establishing and maintaining compliance frameworks.

When is the annual FATCA reporting deadline?

In Singapore, the annual FATCA reporting deadline is 31 May each year for the preceding calendar year. For example, FATCA returns, including NIL returns (if applicable) for 2025, must be submitted to IRAS by 31 May 2026.

Penalties for late filing

Failure to meet FATCA or CRS reporting obligations may result in:

- Monetary fines imposed by IRAS.

- Increased regulatory scrutiny on the financial institution.

- A 30% withholding tax on certain U.S.-sourced payments (in cases of FATCA non-compliance).

How Lanturn Can Help You with FATCA and CRS Compliance

At Lanturn, we provide tailored FATCA services, CRS compliance solutions, and other corporate services for financial institutions and corporates in Singapore. Our team of compliance specialists simplifies the customer identification and reporting process, ensuring accuracy and timely submission to IRAS.

We work closely with companies across the banking, asset management, and fund services sectors to create efficient compliance frameworks. Whether you’re a startup exploring company incorporation in Singapore or an established institution, we ensure seamless adherence to global reporting standards.

Lanturn not only advises on filing compliance for Singapore under CRS but also provides FATCA filing services for other regions like the Cayman Islands and even the British Virgin Islands. In addition, Lanturn also offers CRS reporting services to identify account holders of another jurisdiction, relieving you of concerns about tax evasion.

What Sets Us Apart from Others

- Timely Response

Managing deadlines can be stressful. Our team understands the implications and, therefore, provides timely reminders of approaching deadlines, offering support when you need it most. - Technology

Having the latest accounting software is essential. We have up-to-date software, including in-house XML, that can automate information and streamline the application process efficiently. - Expertise

Our experienced Lanturn specialists have extensive knowledge of global taxation regulations and provide solutions tailored to your business’s needs. - Approach

Our client-centric approach focuses on understanding your business’s needs when preparing FATCA documentation. You will be assigned to a dedicated team or individuals so that you can contact them whenever you need someone to address your concerns.

Filing for FATCA and CRS can take time due to the extensive paperwork involved. However, at Lanturn, our specialists will guide you and ensure you comply with FATCA and CRS regulations. Trust us to assist in customer identification, documentation, and reporting requirements.

Schedule a call with us for any FATCA filing service or to discuss reporting.

FAQs

What is FATCA in simple terms?

FATCA is a U.S. law that requires financial institutions worldwide, including in Singapore, to report financial account details of U.S. taxpayers to ensure accurate and transparent taxation.

What is CRS, and how is it different from FATCA?

CRS is a global reporting standard created by the OECD for automatic exchange of financial account information among more than 100 jurisdictions, while FATCA applies only to U.S. taxpayers.

Who needs to comply with FATCA in Singapore?

Financial institutions such as banks, insurers, fund managers, custodians, and other financial service providers must comply with FATCA obligations in Singapore.

How to fill the FATCA CRS declaration form for NRIs?

NRIs should complete the FATCA CRS form by providing accurate personal details (name, residence, date of birth), declaring their tax residency, supplying their TIN, and signing the form before submission.

What are the penalties for FATCA non-compliance?

Non-compliance with FATCA may lead to IRAS penalties and a 30% withholding tax on U.S.-sourced payments.

What is the CRS reporting deadline in Singapore?

The CRS reporting deadline is usually 31 May each year, the same as the FATCA deadlines.

One Response

good