In today’s crowded venture capital landscape, winning over investors is more challenging than ever. Whether they’re backing early or late-stage startups, venture capitalists (VCs) want to see clear signs that their money will grow. For founders, one effective way to demonstrate profitability and long-term potential is by showcasing your company’s Internal Rate of Return (IRR). While metrics like profit margins, Return on Investments (ROIs), and the like are common for measurement, they can be harder to produce for new startups. That’s why IRR might be a strong alternative. In this blog, we’ll explain the definition of the internal rate of return, its advantages, how it differs from the rate of return, and why it matters to investors in Singapore.

What is Internal Rate of Return (IRR)?

Before we delve into the real business, let us understand the definition of the internal rate of return. You may have encountered this term at some point in your business journey. But what is IRR? What does internal rate of return mean? Here’s the internal rate of return explained:

Internal Rate of Return Definition

An IRR is a financial metric that companies use to measure the profitability of a potential investment. It also serves as a key performance indicator that businesses and investors use to assess the efficiency of an investment.

Internal Rate of Return vs General Rate of Return

What is the difference between rate of return and internal rate of return?

While IRR measures the profitability of a potential investment, the general rate of return (ROR) tells a different story. ROR tracks the overall profit or loss of an investment over a specific period, expressed as a percentage of the initial investment cost. It essentially shows how much its value has grown or shrunk from the time you bought it to when it generates returns.

In a nutshell, ROR captures the total growth of a project from day one, while IRR reveals its annual growth by factoring in the timing of cash flows.

How to Calculate Internal Rate of Return

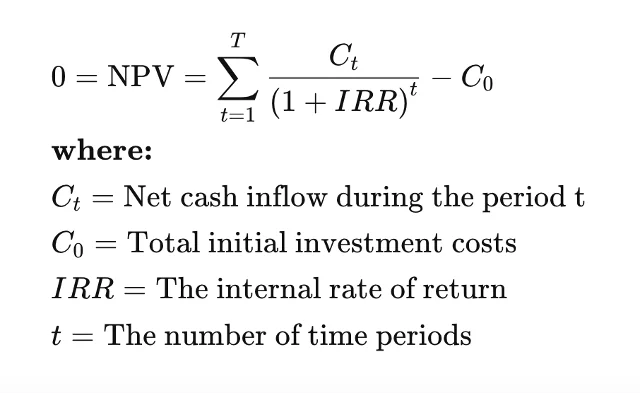

While there is a formula for IRR, it’s not exactly the kind you’d want to tackle by hand, as it can become quite complex. That’s why businesses turn to specialised computer software or online IRR calculators to do the heavy lifting. But if you are curious about what the formula looks like and how it’s calculated, let’s take a look:

How IRR works in Investment Analysis

IRR assists investors in estimating potential returns across various investments during the early stages of analysis, and it functions similarly across different types of investments. This makes it a valuable tool for comparing multiple prospects on an equal footing. Here are the other ways IRR operates in investment analysis.

The Concept of Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) is a valuation method that estimates the value of an investment today based on the cash it’s expected to generate in the future. In simpler terms, it’s a way for analysts and investors to project future earnings and then work backwards to see their value in today’s terms. So, how can one calculate the expected future cash flow? This is achieved by applying a discount rate to calculate the present value of the future cash flows. If the DCF turns out to be higher than the investment’s current cost, it signals a potentially profitable opportunity worth considering.

Internal Rate of Return Rule

Just as the DCF method helps investors and businesses determine whether an investment is worthwhile, the Internal Rate of Return (IRR) rule provides a clear decision-making guide. In simpler terms, if the IRR of an investment is higher than the minimum required return, which is often the cost of capital, it’s usually worth considering. But if the IRR falls short of the benchmark, it might be wiser to reconsider.

Why IRR is Considered a Benchmark Metric

IRR plays a key role in investment decision-making, making it one of the go-to metrics for assessing capital budget projects. It provides a clear, long-term perspective on how annual returns accumulate over time, taking into account every cash flow along the way. This makes it a comprehensive measure of performance—reflecting the effects of critical decisions, from when to deploy and return capital to the timing of an exit. For fund managers, IRR is more than just a number; it’s a compelling story for investors. Limited partners (LPs) pay close attention to it when choosing where to invest, and a strong record of high IRRs can considerably ease the process of attracting new investors.

Advantages of Internal Rate of Return

Aside from being a valuable method for evaluating the most worthwhile projects, there are also other benefits of using IRR during investment assessment.

Simplicity in Decision-Making

Here’s the scenario: you’re deciding between several capital projects to invest in. So, how do you determine which one delivers the best returns? That’s where IRR comes in. It provides a business or investor with a quick snapshot of what capital projects offer the most significant potential cash flow. Beyond investments, IRR is also beneficial for budgeting purposes, such as weighing the potential value of purchasing new equipment versus repairing existing assets. In both cases, it helps you see the bigger picture and make smarter and profitable decisions.

Time Value of Money Consideration

Another advantage of the IRR is that it accounts for the time value of money, the size of the cash flows and the period. In other words, it recognises that the dollar today is worth more than a dollar tomorrow. By calculating the interest rate at which the present value of future cash flows equals the initial investments, IRR factors in the timing of every cash flow – no matter how far into the future. This ensures each cash flow is assessed on an equal footing, making the analysis more credible and meaningful.

Comparison Across Different Investments

Unlike other performance measurement methods, such as return on investment (ROI) and net present value (NPV), the IRR calculation is a valuable tool for comparing different assets with varying cash flow patterns and time horizons. It also enables you to make consistent comparisons across various investments and public market indices, regardless of the time frame.

Why IRR Matters for Investors in Singapore

In Singapore’s competitive startup scene, numerous ventures are vying for a share of investor attention. That’s why understanding IRR and its importance for your investment portfolio is so crucial. Think of IRR as a measure of how hard your money is working for you. A high IRR often signifies that a company has a strong chance of growing your investment, but its value goes beyond chasing impressive returns. For investors, IRR offers a deeper insight into the quality and timing of those returns. It’s critical to know where and when to place your capital.

Importance in Corporate Finance Decisions

In corporate finance, investors use IRR to evaluate potential investments in startups or established companies. By calculating the IRR of expected cash flows, investors can estimate the attractiveness of an investment opportunity and make informed decisions about whether to proceed. It enables investors to compare opportunities side by side, assess their relative risks, and plan where to allocate capital for the most significant impact. By looking at IRR, investors can forecast how their investments might grow over time, providing them with the insight to make informed and strategic decisions. For investors in Singapore’s fast-paced market, that clarity is key to making smarter, more informed choices.

Best Practices for Using IRR in Decision-Making

IRR is a valuable tool for investors. But knowing how to use it effectively can make all the difference. It’s not just about looking at the numbers. It’s about understanding what it means in the bigger picture of your investment strategy. To get the most out of IRR, combine it with other key metrics like Net Present value (NPV), Payback Period and ROI. Here’s what you need to know.

Combine IRR with other Metrics – NPV, Payback Period, ROI

Before diving into details, here’s one thing to keep in mind: NPV, payback period, and ROI are metrics used in capital budgeting and investment planning to analyse a project’s projected profitability.

NPV measures the present value of a project’s net cash flows, discounted to reflect both the cost of capital and the project’s risk. It’s expressed as a dollar figure, showing the current value of future payments from a company, project, or investment. To determine whether the project is desirable or adds value to the company, you can use IRR and NPV to evaluate.

However, NPV doesn’t evaluate a project’s return on investment, which is essential for anyone with limited capital. That is where ROI becomes relevant, as it shows the total return by comparing the present value to the original investment. Unlike IRR, which focuses on annual growth, ROI provides a broader perspective on the overall return. To make well-informed decisions, it’s beneficial to use both of these metrics simultaneously.

The payback period is the time it takes for a project to recover its initial investment, indicating how quickly each dollar invested generates a profit.

Together, these key metrics provide a comprehensive and well-rounded view of an opportunity, enabling you to make smarter, more confident decisions about where to allocate your capital.

Avoiding Common Mistakes – Over-Reliance on IRR

In general, IRR is a valuable tool for investors to analyse potential investments. However, it does come with limitations, and it’s essential not to rely too heavily on a single key metric. Here are some common mistakes to avoid:

Multiple IRR

One of the limitations of IRR is that it can produce multiple values for projects with unconventional cash flow patterns, such as those that involve alternating positive and negative cash flows. As such, it might be challenging to determine which IRR value to use for decision-making. This can confuse investors and potentially lead to misinterpretation of the investment’s profitability.

Overestimation of the Scale of Investment

One of the disadvantages of IRR is that it doesn’t reflect the scale of an investment. A project with a high IRR may look attractive, but it could deliver a much smaller absolute return than a larger project with a lower IRR. This means that relying on IRR for investment decisions can sometimes result in suboptimal choices, as it overlooks the bigger picture, which is the overall impact on the company’s financial position.

Assumed Reinvestment

IRR assumes that all cash flows generated by an investment are reinvested to earn the same return as the IRR itself. However, this may not be possible in real life, as reinvestment rates can vary significantly. This assumption can lead to an overestimation of the investment’s true profitability.

It is essential to recognise the limitations of IRR, and it’s best to use it in conjunction with other financial metrics, such as NPV, ROI, and Payback Period, to gain a comprehensive understanding of an investment’s potential. A thorough analysis that considers multiple factors will lead to more informed investment decisions and better financial outcomes.

Summary Table – IRR Key Takeaways

- An IRR is a financial metric that companies use to measure the profitability of a potential investment.

- The IRR calculation is a valuable tool for analysing capital budget projects when comparing different assets and potential annual rates of return over time.

- IRR provides a clear, long-term view of how annual returns accumulate over time, taking into account every cash flow along the way.

- IRR offers an insight into the quality and timing of investment returns.

- The benefits of using IRR include accounting for the time value of money and quickly showing investors or businesses, which capital projects offer the most significant potential cash flow.

- IRR is a powerful decision-making tool, but it’s not flawless. For projects with irregular cash flows, it can produce multiple values that may confuse investors. It also assumes all cash flows are reinvested at the same rate, which can exaggerate an investment’s true profitability.

Power Your Business Growth with Lanturn’s Fund Services

While the Internal Rate of Return (IRR) has its limitations, it remains one of the most trusted tools for evaluating capital budget projects in the industry. Whether you’re a foreign investor eyeing Singapore’s startup scene or an established business seeking growth, IRR helps you compare investment opportunities, gauge risk, and allocate your capital wisely.

But Singapore’s venture capital landscape can be complex, and IRR calculations aren’t always straightforward. That’s where Lanturn comes in. At Lanturn, our team of experts not only handle your IRR calculations with precision but also keeps your finances on track, such as spotting cash flow issues early and preventing poor financial management. With Lanturn supporting your business, you can focus on what matters most while we ensure your investment strategy stays ahead of the game. Ready to take the first step? Speak to our team today.

FAQs

What is IRR in simple terms?

The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of the project zero. Simply put, IRR is a metric used to estimate the return on investment. The higher the IRR, the better the return on an investment.

What is the difference between the rate of return and the internal rate of return?

The difference between the rate of return (ROR) and the internal rate of return (IRR) lies in how they track the growth of investments. ROR tracks the overall profit and loss of an investment over a specific period, while IRR reveals the yearly growth rate along the way.

What is the internal rate of return rule?

The internal rate of return rule is a guideline that states a project or investment is worth considering if the IRR is greater than the minimum required rate of return, or hurdle rate. It usually helps investors to decide whether to proceed with one project or another.

How to calculate the internal rate of return in Excel?

A common method for calculating the internal rate of return is using Microsoft Excel. It can be calculated using this process:

Step 1: Enter all the cash flows associated with the investment or project. They can be positive (inflow) and negative (outflow).

Step 2: Organise your cash flows in chronological order, with the initial investment at the beginning and the subsequent cash flows listed in order.

Step 3: Use the IRR function in the cell where you want the value to display. The syntax for the IRR function is =IRR(values). The “values” refer to the range of cells containing the cash flows. When calculating, make sure you select all cash flows, including the initial investment.

What are the advantages of the internal rate of return?

When applied in decision-making, IRR gives investors a clear view of which capital projects offer the most significant potential cash flow. It also accounts for the time value of money, factoring in the timing of every cash flow, whether near-term or far into the future. This makes the analysis more balanced, credible, and meaningful. Most importantly, IRR enables you to compare investment opportunities with different cash flow patterns and time horizons.

What is the difference between IRR and ROI?

IRR and ROI are methods for measuring the performance of an investment, but they serve different purposes. IRR shows the annual growth rate, making it a suitable metric for measuring performance in long-term investments. On the other hand, ROI represents the total growth since the project began. For those tracking performance for short-term investments, ROI will be a better gauge.