Consistently ranked #1 globally in the EIU’s Business Environment Ranking, Singapore is renowned for its pro-business climate, transparent regulatory framework, and excellent infrastructure. Its strategic location also makes it an ideal gateway to the Asia-Pacific region, giving entrepreneurs and investors access to a vast regional market.

If you have a brilliant business idea buzzing in your head, Singapore is an attractive place to start or expand a business. In this comprehensive guide, we will outline the essentials of running a private limited company in Singapore, from its key features to the role of the partnership agreement.

What is a Private Limited Company?

To start a business in Singapore, entrepreneurs must register with the Accounting and Corporate Regulatory Authority (ACRA). Among the seven types of companies that can be incorporated in Singapore, the private limited company is the most common and preferred choice for both local and foreign entrepreneurs. Here’s why.

Private Limited Company Singapore Definition

A private limited company is a locally incorporated business structure that is distinct from its owners and shareholders.

What is the Meaning of a Private Limited Company?

So, what does that mean? This means that the company and the owners are separate entities. The owners and shareholders are liable up to the amount they invest. If the company encounters financial or legal difficulties, the owner’s personal assets will be protected. This business structure provides businesses with limited liability protection.

Additionally, the company can own assets, enter into contracts and take on liabilities, providing a clear layer of protection for its owners.

Features of a Private Limited Company

Here are some key features of a private limited company:

- It’s a separate legal entity from its owners and shareholders. This means it can sue and be sued in its name. Additionally, it can own assets in its name.

- The company can own property in its name and enter into contracts.

- The company director and shareholders have limited liability to the company. They are not liable for the company’s debts, and their personal assets are protected from the creditors.

- A private limited company ltd can have between 1 to 50 shareholders.

- It is limited by shares, which are typically held and sold privately.

- Profits are taxed at a corporate tax rate of 17%. Private limited companies can also benefit from Singapore’s tax exemptions and other incentives.

- Private limited companies have perpetual succession, meaning the business continues even if shareholders change or the directors pass away. This ensures continuity and facilitates long-term planning.

Why Choose a Private Limited Company in Singapore

Setting up a Singapore private limited company not only reflects professionalism and credibility, but it also allows you to raise capital and strengthens your chances of securing commercial loans from banks or financial institutions. Beyond this, a private limited company ltd offers a host of benefits that make it an attractive business structure for business growth and long-term success:

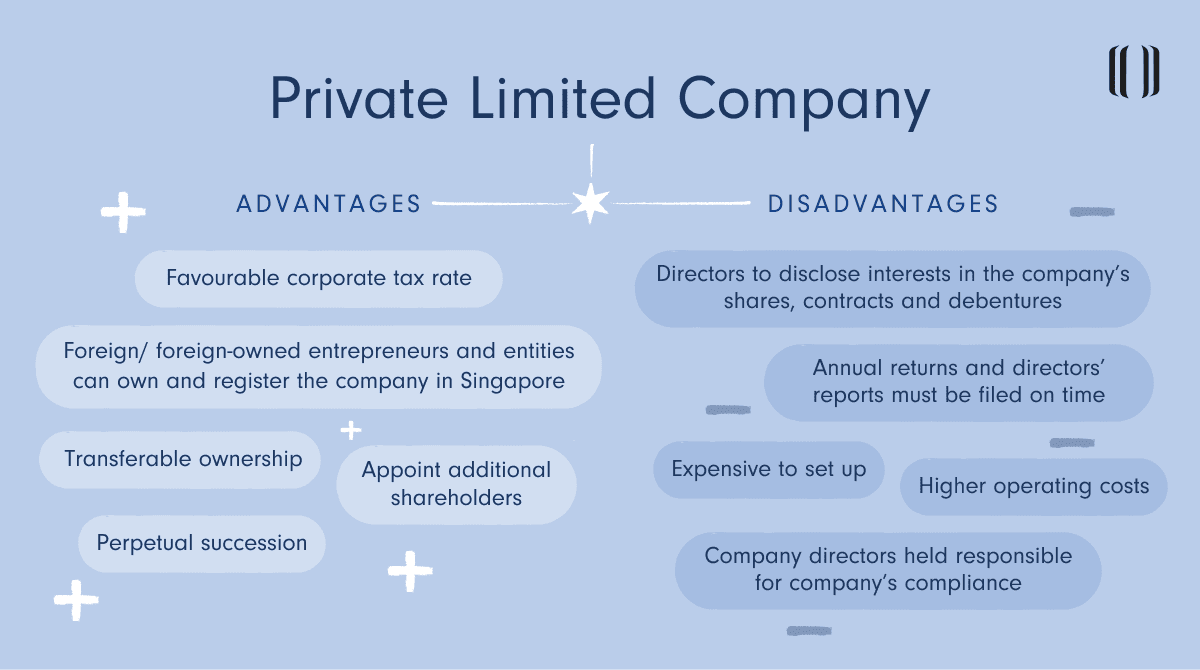

Advantages of a Private Limited Company in Singapore

- Currently, Singapore private limited companies are taxed at a favourable 17% corporate rate. New startups can enjoy a 75% tax exemption on the first S$100,000 of chargeable income for their first three years and a 50% exemption on the next S$100,000. Foreign entrepreneurs can also access support through schemes like EntrePass.

- Foreign entrepreneurs and foreign-owned entities can own and register the company in Singapore, including holding 100% of the company shares. However, a local resident director who is a Singapore citizen or permanent resident is required. You can either appoint a nominal director or obtain an Employment pass to manage the company.

- Ownership of the company can be transferable, and additional shareholders can be appointed.

- A private limited company has perpetual succession, meaning that its business operations will not be disrupted if there is a change in shareholders or if directors pass away.

Disadvantages of a Private Limited Company in Singapore

While a private limited company offers many advantages for entrepreneurs, it also comes with strict compliance requirements that may necessitate a dedicated team to manage regulatory compliance effectively.

- Company directors must disclose to the company information about their interests in the company’s shares, contracts and debentures.

- Annual returns and directors’ reports must be filed on time. Hence, the company must appoint at least one director and one company secretary.

- ACRA holds the company directors responsible for ensuring the company’s compliance with the Companies Act.

- It can be more expensive to set up.

- The administration requirements and increased disclosure lead to higher operating costs.

Procedure for Incorporation of a Private Limited Company

At this stage, you might already feel the excitement of turning your business ideas into reality in Singapore. However, before diving straight into business strategies and growth plans, it’s important to first understand the fundamentals – starting with the procedure for incorporating a private limited company in Singapore.

Foreign entrepreneurs seeking to register a business entity in Singapore must appoint a registered filing agent to submit an application via Bizfile, ACRA’s online business registration and filing portal, as a Singpass is required to access it. This agent can be an accounting firm or a corporate secretarial company, such as Lanturn. While it’s not mandatory for locals, engaging a corporate service provider is recommended as they stay up-to-date with the latest regulatory changes and can streamline the process for you.

Reserving a Company Name with ACRA

You need to choose a company name and submit the name application to ACRA via Bizfile. It is crucial to choose an appropriate name, as it is a key part of your company’s brand identity. Your proposed company name must not be identical to an existing name or contain any inappropriate or illegal words. Once ACRA approves your company name, it will be reserved for a period of 120 days. You then have this period to incorporate your company before the reservation expires.

Filing Incorporation Documents

Aside from choosing a company name, you will need to file the following documents for your company incorporation:

Shareholder’s Details

Under the Companies Act in Singapore, a private limited company can have between 1 and 50 shareholders. A director and shareholder can be the same person or different individuals. You will need to provide their personal information and shareholdings. However, please note that shareholders’ details will be available on public records.

Director’s Details

It’s a requirement for a Singapore private limited company to have at least one director who is a Singapore citizen, a Singapore permanent resident, or a foreign individual with an Employment Pass, EntrePass, or Dependants’ Pass, with a residential address in Singapore. Please note that information about the directors will be available in public records.

Company Secretary’s Details

Under the Companies Act, every private limited company must appoint a company secretary within six months of its incorporation. The secretary ensures the company remains compliant with regulatory requirements, a role that requires specific expertise and up-to-date knowledge of Singapore’s corporate laws.

Appointment of Auditors

Every incorporated company is required to appoint an auditor within three months of its incorporation, unless it is exempt from audit requirements.

Share Capital/Paid up Capital

To register a company, the minimum paid-up capital is S$1. When your company is incorporated, you’ll issue at least one share to your initial members. Your issued share capital is simply the total number of shares in the company multiplied by the nominal value of each share.

Shareholder’s Agreement

A shareholder’s agreement is a formal document that outlines the relationship between shareholders and specifies their respective rights and obligations. As such, it’s crucial to have a proper shareholders’ agreement in place to avoid any disputes.

Company Constitution

A company constitution outlines the company structure, rules and operations. It includes the company’s name, registered office address, business activities, share capital, etc. It’s a crucial document that defines the internal workings of the company.

Registered Office Address

You’ll need to provide a registered office address as all official correspondence will be delivered to this address. The registered office address must be a physical address, not a P.O. Box. Residential addresses are accepted for a specific type of business.

Once you have gathered all the documents mentioned above, you are ready to submit your application to ACRA. If you’re worried about overlooking important information, Lanturn has a team of experts specialising in incorporation matters, and we have assisted numerous companies in setting up their businesses in Singapore.

Issuance of Certificate of Incorporation

Once your company is successfully incorporated, ACRA will email the Certificate of Incorporation to you. The Certificate of Incorporation is a formal, official document that contains the company’s Unique Entity Number (UEN), a standard identification number for any entity registered in Singapore, business name, business activities, incorporation date, and information about your partners and business holders. If you prefer a hard copy, it is also available for purchase.

Read more: What Is The Date Of Incorporation Of A Company And Why It Matters?

Setting Up a Private Limited Company in Singapore (ACRA Requirements)

Setting up a private limited company in Singapore requires entrepreneurs to comply with ACRA’s rules and regulations. To help you stay on track, here are the important ACRA requirements:

Shareholders, Directors, and Company Secretary

Shareholders

Every private limited company is required to have at least one corporate or individual shareholder and a maximum of 50 shareholders.

Directors

The company director plays a vital role in overseeing accurate record-keeping, preparing financial statements and ensuring the company stays compliant with all required filing and disclosures. The director also carries a legal duty to act honestly, in good faith, and always in the best interests of the company.

Foreigners who wish to relocate to Singapore to manage a company must obtain approval from the Ministry of Manpower (MOM) after the company has been incorporated. Alternatively, they can appoint a registered corporate service provider, such as Lanturn, to handle the incorporation submission on their behalf.

Company Secretary

A company secretary is responsible for the administration of the company and is required to ensure that all directors and shareholders are informed of their statutory obligations, such as filing annual returns.

Other responsibilities include:

- Maintaining and updating the company’s registers and minute books

- Administering, attending and preparing minutes of meetings of directors and shareholders

- Updating directors and shareholders on relevant changes in corporate regulations

- Informing company directors of the annual returns deadlines and other ACRA filings

Given its significance, companies must appoint a company secretary within 6 months of the date of incorporation. It cannot remain vacant for more than 6 months, or the director may face a penalty.

Unlike a shareholder, who may also serve as a company director, a company director cannot assume the role of a company secretary.

Paid-up Capital and Registered Address

Paid-up Capital

The minimum issued paid-up capital for incorporating a company is S$1. The paid-up capital also refers to the amount of money that shareholders have paid to the company for their shares.

Registered Address

A registered office address is required because all official letters and documents from government authorities will be sent to this address. It must be a physical location and cannot be a P.O. Box. Additionally, this registered office address must be shown on all official company documents.

Running a Private Limited Company: Key Compliance Steps

Now, your company is finally incorporated, that’s great! But the journey doesn’t stop here. Running a private limited company will require you to remain compliant with the Companies Act and ACRA. Not sure what to keep in mind? We’ve got you covered.

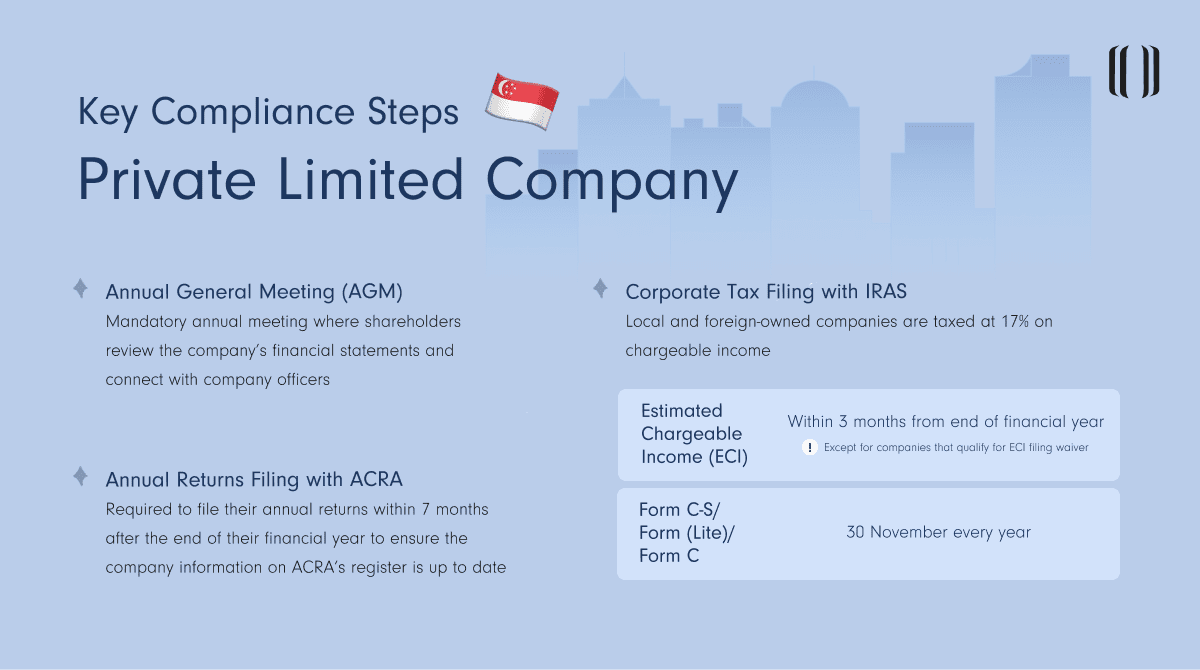

Annual General Meeting (AGM) – When and How to Hold It

An Annual General Meeting (AGM) is a mandatory annual meeting where shareholders review the company’s financial statements and connect with company officers. Companies must hold an AGM within 6 months after the company’s financial year-end.

Annual Returns Filing with ACRA – Deadlines and Penalties

Under the Companies Act, private limited companies are required to file their annual returns within 7 months after the end of their financial year to ensure the company information on ACRA’s register is up to date. This includes the AGM dates (if held) and the financial statements.

Filing a company’s annual return promptly ensures proper and timely disclosure to all stakeholders, while failure to comply will lead to enforcement actions.

Corporate Tax Filing with IRAS – Forms and Submission Process

Staying on top of corporate tax filing requirements is key to compliance. Both local and foreign-owned companies are taxed at 17% on chargeable income. This includes profits from business, investments, interest, rent, royalties, and property. Any income that is brought into Singapore from abroad is also taxable.

Private limited companies are required to file two Corporate Income Tax Returns with the Inland Revenue Authority of Singapore (IRAS):

| Tax Return Document | Filing Deadlines |

|---|---|

| Estimated Chargeable Income (ECI) | Within 3 months from the end of financial year, except for companies that qualify for ECI filing waiver. |

| Form C-S/Form C-S (Lite)/Form C | 30 November every year |

This includes reporting your company’s income from the previous year, known as the Year of Assessment (YA). You’ll declare chargeable income after deducting tax-allowable expenses, capital allowances, and reliefs.

Maintaining Statutory Registers & Records – What to Track

Company statutory records are official documents that every incorporated company in Singapore is legally required to maintain under the Companies Act. These records are kept by ACRA in electronic form and must always reflect the most up-to-date information about the company.

For instance, if there are any changes in the appointments or particulars of directors, secretaries, auditors and CEOs, the updates must be filed via Bizfile within 14 days from the date of the change. Similarly, any changes involving the company’s shareholders or share capital must be filed through Bizfile. These registers are publicly accessible to promote transparency, support due diligence, and build trust. By allowing businesses, investors, and the public to verify key information, statutory records help facilitate trade and promote accountability among Singapore companies.

Why it’s Important for Shareholders

A well-crafted shareholders’ agreement outlines the rights, responsibilities, and relationships between shareholders. In contrast, a partnership agreement addresses key areas, including profit and loss distribution, decision-making, dispute resolution, and the duration of the partnership. Both agreements serve similar objectives: to help mitigate future disputes and disagreements.

Key Clauses in a Partnership/Shareholders Agreement

Ideally, a well-structured partnership or shareholders’ agreement should include the following key clauses:

- The scope and the objectives of the joint venture

- Roles, responsibilities, and remuneration of each partner

- Contributions of individual partners, in terms of cash and sweat capital

- Policy related to the distribution of profits and making decisions

- Restrictions on the issuance of new shares or transfer of shares (including tag-along and drag-along provisions)

- Procedure for the withdrawal of old partners and the admission of new ones

- Dispute resolution

- Procedures for dissolving the partnership

Embark on Your New Business Venture with Lanturn’s Incorporation Services

Ready to start a new business in Singapore?

Embarking on your new startup in Singapore is an exhilarating adventure, as setting up a private limited company comes with a wealth of benefits, including scalability, enhanced credibility, perpetual succession, limited liability protection and a legal separation from its owners.

To simplify your incorporation process, professional corporate service providers like Lanturn can help you navigate every step of the journey. From assisting in key personnel roles and filing annual returns to ensuring compliance with statutory requirements, our end-to-end solutions are designed to meet your business needs. We provide ongoing support, including maintaining accurate tax records, filing annual returns, and keeping you updated on regulatory changes. Our team of experts is also equipped to advise on matters such as drafting partnership agreements, ensuring your business is always protected and future-ready. Focus on growing your business while we take care of the details. Speak to us today, and let’s bring your business vision to life with confidence.

FAQs

What is a Private Limited Company in Singapore?

A private limited company is one of the five main types of business entities in Singapore. It is recognised as a separate legal entity, meaning the company exists independently from the shareholders. This separation protects the owners, as the company, not the shareholders, is liable for the debts and losses.

What are the Features of a Private Limited Company?

A private limited company comes with the following key features:

- It can own assets and enter into contracts.

- It allows up to 50 shareholders.

- Profits are taxed at Singapore’s corporate tax rate of 17%.

- It is limited by shares, which protects shareholders’ liability.

- It enjoys access to Singapore’s tax exemptions and other incentives.

- It is credible and has perpetual success, which means the company continues to exist if the shareholders or directors change.

How to register a private limited company in Singapore?

These are the steps required to register a private limited company in Singapore:

Step 1: Choose a company name. It’s advisable to choose a company name that is not identical to any existing names or contains any prohibited or undesirable words.

Step 2: Choose a financial year. It’s essential to choose your financial year carefully, as it will determine the due date of your annual returns and tax filing.

Step 3: Appoint at least one company director and one company secretary. Both roles must be held by a Singapore citizen. The company director can be a Singapore citizen, a Singapore Permanent Resident, an EntrePass holder, or an Employment Pass holder.

Step 4: Appoint an auditor within 3 months of incorporation, unless your company is exempt from audit requirements

Step 5: Provide a minimum initial paid-up capital of S$1

Step 6: Have between 1 and 50 shareholders, which can be an individual or a company

Step 7: Provide a registered office address

Step 8: Submit a copy of the Company’s constitution, an official document that outlines the rights and responsibilities of the directors, shareholders and company secretary.

How is a private limited company taxed in Singapore?

Private limited companies in Singapore are taxed at a corporate tax rate of 17% with additional exemptions and other incentives.

Can a foreigner own a private limited company in Singapore?

Yes, Singapore permits foreign entrepreneurs and foreign-owned entities to hold 100% of the company’s shares, making Singapore a favourable place for foreigners to start a business venture.

What are the compliance requirements for private limited companies?

Private limited companies must remain compliant with the statutory obligations set out by ACRA and the Companies Act. This includes holding the Annual General Meeting, filing Annual Returns, and filing Corporate Income Tax Returns for Form C-S/C and Estimated Chargeable Income (ECI).

What is the difference between a sole proprietorship and a private limited company?

A sole proprietorship is owned and operated by one person. It’s not a separate legal entity from its owner and has an unlimited personal liability. This means the owner is responsible for the company’s debts and losses. In contrast, a private limited company is a separate legal entity with multiple shareholders, offering limited liability and greater capital flexibility, making it a preferred choice for many entrepreneurs.