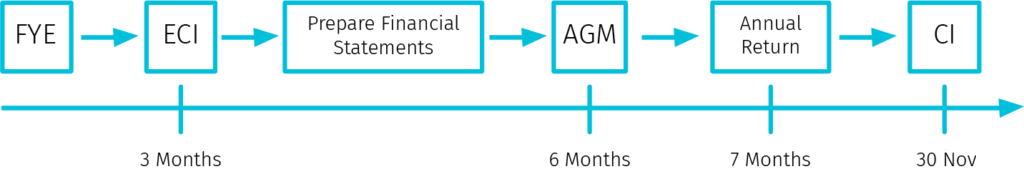

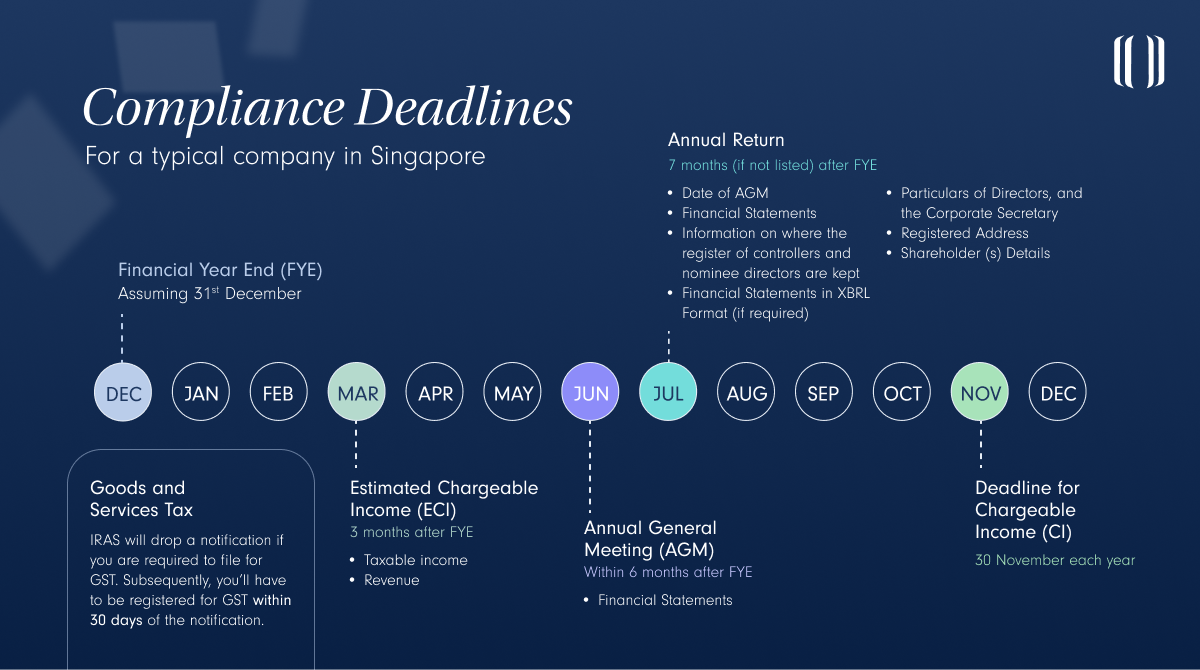

Running a company can be challenging due to the need to meet multiple compliance deadlines. That’s why we’ve created a Singapore economic calendar, a simple and comprehensive financial guide highlighting the important events and dates to be remembered. At a glance, here is the timeline for a typical company. This assumes their Financial Year End (FYE) is 31st December.

Singapore Economic Calendar

Estimated Chargeable Income (ECI)

When: 3 months after FYE The Inland Revenue Authority of Singapore (IRAS) requires an estimate of a company’s taxable income for the Year of Assessment (YA). Here’s what you need to provide:

- Taxable income

- Revenue

Click here to check if your company is exempted from filing an ECI

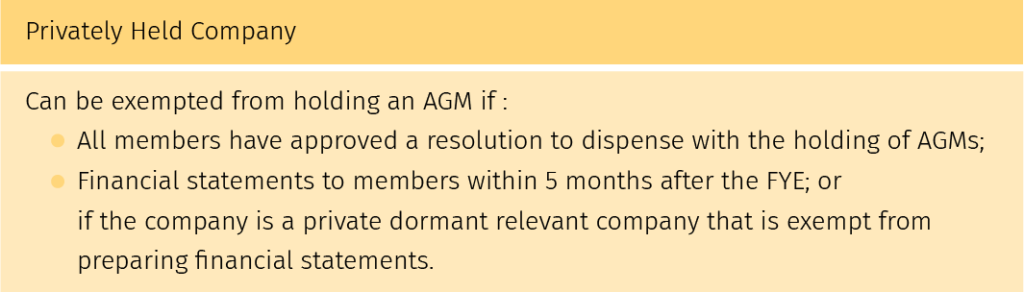

Annual General Meeting (AGM)

When: Within 6 months after FYE AGM’s are critical for keeping your shareholders informed on your business operations. What you need to prepare:

- Financial Statements

Note: The AGM notice needs to be disseminated to shareholders at least 14 days before the meeting itself.

Annual Return

When: 7 months (if not listed) after FYE The annual return is an electronic form that needs to be lodged with ACRA. It contains important particulars about the company, and must include:

- Particulars of Directors, and the Corporate Secretary

- Registered Address

- Shareholder (s) Details

- Date of AGM

- Financial Statements

- Information on where the register of controllers and nominee directors are kept

- Financial Statements in XBRL Format (if required)

Chargeable Income (CI)

Your CI is your final tax calculation submitted to IRAS and is a much more complicated submission than the ECI. You’ll need to give IRAS details on your accounting profit, non-taxable income, and disallowed deductions, as well as any specific tax calculations required by the Income Tax Act. For more details, please click here.

Something to specially highlight in your financial calendar is the deadline for filing your CI is 30 November each year, as IRAS has phased out the option of paper filing your Chargeable Income from 2020. Let us know if you’d like us to help submit your tax.

Goods and Services Tax

Depending on the revenue your business is expecting, you may need to file for GST. GST will apply if your business turnover is more than $1Million in the past 12 months, or if you expect the turnover to exceed $1Million. IRAS will drop a notification if you are required to file for GST. Subsequently, you’ll have to be registered for GST within 30 days of the notification.

2023 Dates to Remember

Here are some dates that would be helpful to add up to your financial calendar:

01 Jan 2023: GST increase from 7% to 8%

01 Mar 2023: Deadline for e-submission of commission

15 Apr 2023: Due date for paper filing of Individual Income Tax

18 Apr 2023: Due date for E-filing of Individual Income Tax

01 Sep 2023: Increase in CPF contribution rates, the start of Complementary Assessment Framework (COMPASS) for EP applications and updates to S Pass eligibility

Other than this 2023 Singapore economic calendar, Lanturn had also crafted a guide filled with tips and tricks for the tax season for small business owners, which you might find beneficial. If you’re still unsure about the requirements and specifics of preparing for these milestones, drop us a message!