Another change has come in Singapore’s fiscal landscape with the upcoming implementation of the 2024 Goods and Services Tax (GST) rate change. Let us dive into the intricacies of this impending adjustment, shedding light on the origins and implications of the Singapore GST rate change set to take effect in the coming year. Let us further explore how this development will impact not only GST-registered businesses but also individuals, providing you with essential insights to navigate this economic transition.

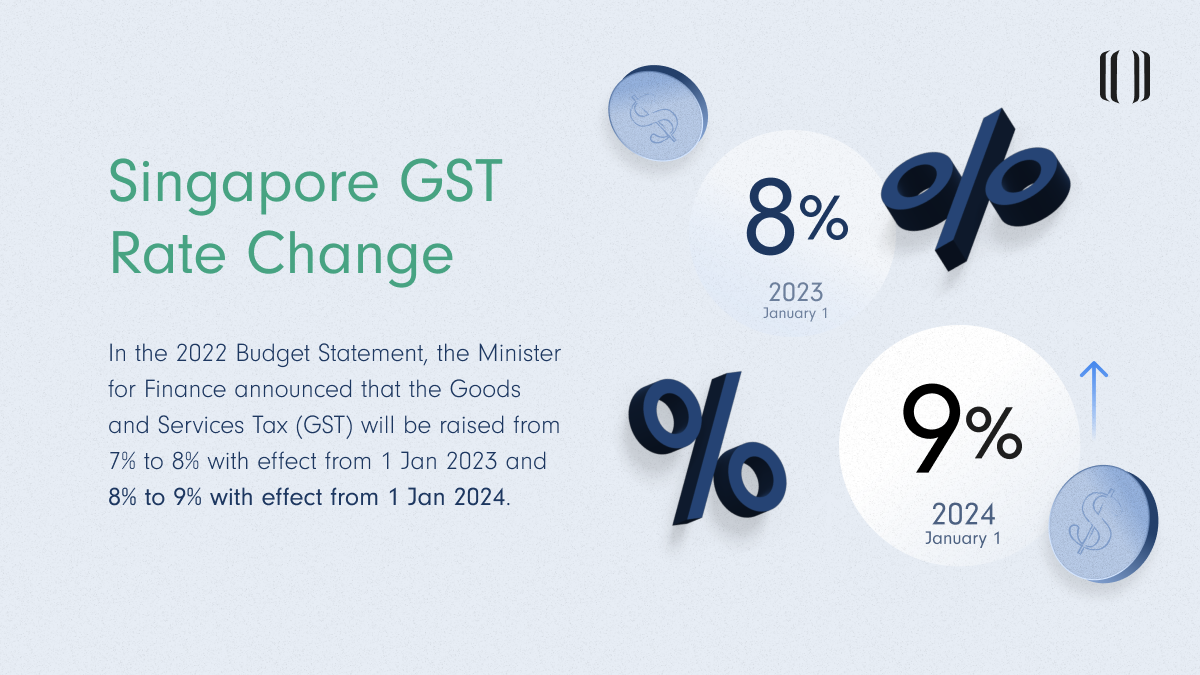

Singapore GST Rate Change

In response to evolving economic conditions, the Singaporean government introduced a two-stage GST rate increase, which had been announced when Deputy Prime Minister (DPM) and Minister for Finance Lawrence Wong delivered the Singapore Government’s Budget Statement for Financial Year 2022 in Parliament last 18 February 2022. Originally proposed in 2018, this plan was aimed to raise Singapore’s GST from 7% to 9% within the 2022 to 2025 timeframe. However, unforeseen challenges brought on by the Covid-19 pandemic necessitated a postponement.

Consequently, the GST rate adjustment was divided into two phases:

- The first increment, from 7% to 8%, took effect on January 1, 2023,

- Followed by the second increase to 9%, which will commence on January 1, 2024.

Related Reference: Lanturn’s Beginner’s Guide to Singapore’s GST

The Two-Stage GST Rate Change

The upcoming 2024 GST rate change in Singapore is a significant fiscal milestone, marked by a carefully planned two-stage GST rate adjustment. Let’s delve into the details of each phase:

Phase 1: 2023 GST Rate Increase

On January 1, 2023, the first phase of the GST rate adjustment came into effect, raising the GST rate from 7% to 8%. This change meant that purchases of goods and services from GST-registered businesses in 2023 were subject to GST at the rate of 8%.

Phase 2: 2024 Upcoming GST Rate Increase

The second phase of the GST rate adjustment is set to occur on January 1, 2024. At this juncture, the GST rate will increase from 8% to 9%. Any purchases made on or after this date will be subject to GST at the new rate of 9%.

However, it’s essential to note that certain scenarios may straddle the January 1, 2024 transition date. This includes situations involving the issuance of invoices, payments for goods or services, or the receipt of goods or services. For these particular cases, special GST rules will come into play to ensure a smooth and fair application of the new rate.

Businesses are strongly encouraged to prepare proactively for this transition. To assist businesses in navigating this change effectively, the Inland Revenue Authority of Singapore (IRAS) has issued an e-tax guide specifically tailored for GST-registered businesses.

GST Rate Change Implications and Impact

With the 2023 GST rate adjustment behind us and the 2024 increase on the horizon, it is crucial to understand how these shifts will affect both businesses and individuals in Singapore. Let us take a closer look at the real-world implications of these changes and explore the government’s thoughtful measures to help ease the transition.

Implications for Businesses:

- System Adjustments -Businesses must adjust systems (e.g., point-of-sale, invoicing, accounting) to reflect the new GST rate, ensuring compliance.

- Price Displays – Updating price displays is crucial to prevent consumer confusion or disputes.

- Correct GST Charging – Accurate GST rate charging, considering transitional rules, is vital to avoid penalties and disputes.

- Higher Costs – The GST rate increase may raise operational costs, impacting profitability. Careful financial planning is essential.

- Passing on Costs – Some businesses may pass increased costs to customers, potentially raising prices and affecting consumer behaviour and competitiveness.

Implications for Individuals:

- Higher GST Rate – The GST rate increase will raise the cost of goods and services from GST-registered businesses, affecting the cost of living for individuals and households once more.

- Rising Prices – Higher GST can result in increased prices for various goods and services, potentially impacting household budgets and spending habits even more.

- Marginal Personal Income Tax (PIT) Rate – The top marginal PIT rate is set to rise from 22% to 24% from the year of assessment 2024, which may impact high-income individuals combined with the GST rate increase.

- Safety Net for Lower-Income Households – As per the Singapore Budget 2023 enhancements, the government has improved the permanent GST Voucher scheme and the Assurance Package to ease the burden on lower-income households.

- Permanent GST Voucher Scheme:

- The GSTV Cash component will be increased from S$500 to S$700 per year for eligible Singaporeans residing in homes with an annual value of S$13,000 or below.

-

- The GSTV Cash component will be increased from S$500 to S$850 per year for eligible Singaporeans residing in homes with an annual value of above S$13,000 but below S$21,000.

- Assurance Package:

-

- The AP Cash component will be increased from S$700 to S$800 per adult Singaporean in 2023.

- A one-off special payment of S$100 will be made to all eligible adult Singaporeans in December 2023.

- The AP Utilities Credit will be extended by six months to June 2024.

Thankfully, the Singapore government has initiatives and schemes for SMEs, along with various tax deductions available to qualified companies and individuals in the country. When used properly, they could all be beneficial for handling the GST changes and tax payments.

2024 GST Rate Change Preparations

Here are some practical tips and guidance to ensure a smooth transition and make the most of government measures.

For Businesses:

- Ensure your accounting software, invoicing system, cash register, and point-of-sale system are updated to incorporate the new 9% GST rate, effective from January 1, 2024.

- Inform your customers about the new GST rate by updating your prices and make sure all your price displays are also up to date.

- Review contracts and agreements to ensure they reflect the new GST rate.

- Train your staff on the GST rate change and how to apply it correctly.

- Be aware of the penalties for failing to account for GST on your supplies at the correct rate.

- Consider availing accounting and tax services from professionals like Lanturn for expert assistance in navigating the GST rate change effectively.

For Individuals:

- Plan your expenses and budget accordingly to accommodate the higher GST rate starting 01 January 2024.

- Be aware of transitional rules for supplies spanning the first GST rate change, and ensure you are charged the correct GST rate on your purchases.

- Take advantage of government support measures such as the Assurance Package and the permanent GST Voucher scheme, designed to help Singaporeans cope with the impact of the GST rate increase.

You might also find it beneficial to learn some practical tips for navigating Singapore’s tax season, as well as the benefits of outsourcing your accounting and bookkeeping processes to professionals.

Lanturn Accounting & Tax Services: Your GST Transition Partner

Get ahead of the game by preparing for the upcoming 2024 Singapore GST rate change. Here’s why Lanturn’s professional accounting services are your best choice:

- Expert Guidance: Our in-house experts know the Singapore tax landscape inside out. They’ll provide you with specialized guidance to prepare your business for the GST rate changes.

- Unlock Tax Benefits: Lanturn helps you explore tax incentives, deductions, and credits for GST-registered businesses. We’ll guide you in navigating these incentives, managing the GST rate increase’s impact, and crafting a tailored tax strategy.

- Efficiency Through Technology: Our advanced tools, including automated expenses, integrated platforms, task management, and OCR technology, ensure efficient and accurate financial processes.

- Comprehensive Services: Beyond accounting, Lanturn offers GST Registration and GST quarterly filing services. Switching to our services is seamless, even if you’re currently with another provider.

Prepare for change with confidence—partner with Lanturn Accounting & Tax Services. Join the many businesses and individuals who have experienced the difference with Lanturn’s expert services.

Schedule a call with Lanturn today, and let’s navigate the path to financial success together.