This article explains the steps they need to perform to do this.

Here are some tips to share with your clients:

Downloading WhatsApp

If you do not yet have WhatsApp, this can be downloaded from the relevant Google Play and App Store on your mobile device. You will need the mobile app to begin submitting.

If you are connected to multiple entities, the integration will check with you which entity you’d like to submit each item to before each submission.

Step 1: Add your mobile number in your profile

Navigate to your user profile (top right hand side of your portal) and add in your WhatsApp registered country code and phone number.

Step 2: Add the Zave contact and Verify your number

Follow the link ” Click here to verify your mobile number with us” to send your verification code to the Zave contact (+65 8143 7310).

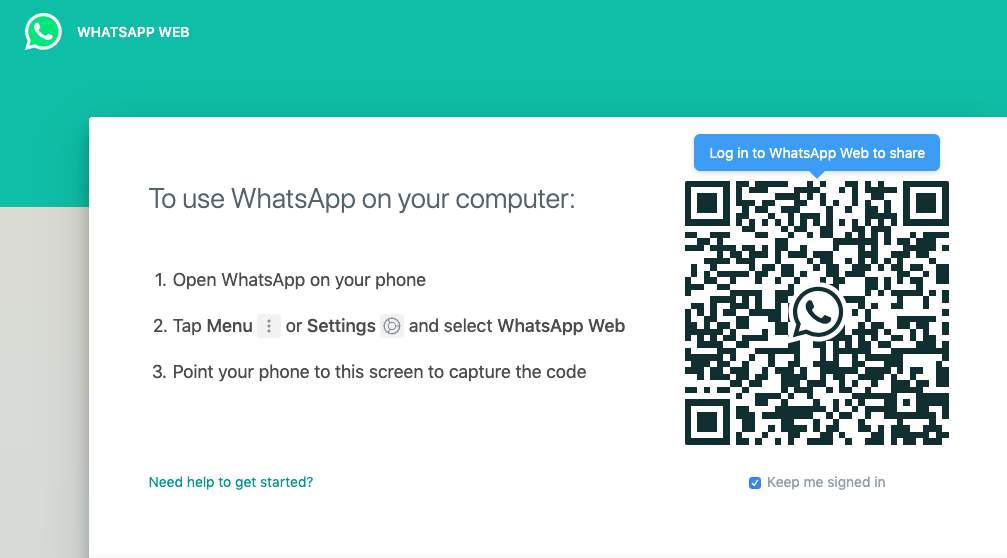

Note you will be taken to WhatsApp web. If you are not logged in already you will need to scan the QR code with your phone given by WhatsApp webpage.

Your verification code will be sent to the contact.

Step 3: Send Staff Expenses to the Zave contact.

You are now verified and can begin submitting expenses to Zave!

Step 4: Select the entity

If you are a user for multiple entities, please select which entity the transaction relates to by entering the digit associated with the entity. In the example above if the expense relates to ‘MaxProfit Ventures’ you should enter ‘3’.

From here, your Expenses will be processed by your Service Provider after which they will appear in your Zave portal under the ‘Expenses’ section.