In recent years, company incorporation in Singapore has become the preferred choice of entrepreneurs. Given its status as a super economy and track record as home to well-known companies, such as Apple, Microsoft, and McDonald’s, the United States has long been considered a favourable place to set up a business. However, as time progresses the advantages of forming a company in the US are less significant than they once were. Instead, Asian countries such as Singapore have more business-friendly regulations. This can be seen by the fact that Singapore was ranked second as the most business-friendly country by the World Bank, whereas the US came in 6th. There’s also no shortage of startups (Company Incorporation) in Singapore with the likes of Super App, Grab, and e-commerce sites Lazada and Shopee, which have become household names within the ASEAN region.

Company Incorporation

Incorporating a business in Singapore can be done online via the BizFile+ portal, and only takes approximately 15 minutes to be processed. Afterwards, a notice of incorporation will be emailed as proof. You need only set aside S$315 for the incorporation process to be completed, consisting of a S$300 registration fee and a S$15 company name fee.

Meanwhile, incorporating a business takes up more time in the US. The Doing Business Report by the World Bank found that the application process is approximately seven business days. This process can be expedited with an additional fee on top of the US$200 filing fee. There are three expedited options to choose from; a two-hour turnaround (US$150), a same-day service (US$75), and a 24-hour turnaround (US$25).

While it’s true that incorporating a business can be cheaper in the US if you opt not to expedite the incorporation process, the difference between the days needed to complete the process is quite stark. If you want to register your business in the US as fast as you can incorporate a company in Singapore, you’ll be paying much more.

Taxes

Personal Income Tax

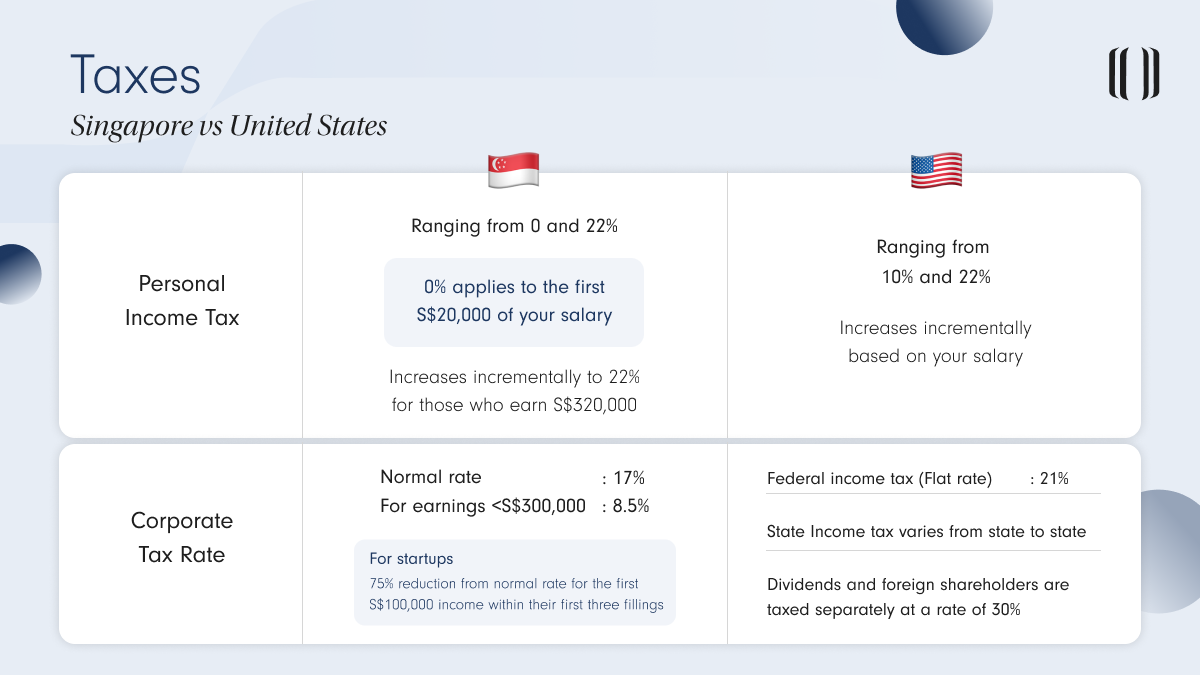

Singapore adopts a progressive tax structure between 0 and 22%, meaning that the higher your income, the higher your tax rate will be. The 0% applies to the first S$20,000 of your salary and it increases incrementally to 22% for those who earn S$320,000. Moreover, foreign-earned income is non-taxable in Singapore, meaning the money you earn and spend outside Singapore will not be taxed. The same cannot be said in the US, where citizens still need to pay taxes to the US government even though they work overseas.

The tax rate is also much higher in the US, ranging from 10% to 37% with a similar progressive structure to Singapore.

Corporate Tax Rate

The corporate tax rate in Singapore stands at 17% since 2010. If your company earns less than S$300,000, you’ll be entitled to an 8.5% tax rate. For startups, they’ll get a 75% reduction from the normal tax rate for the first S$100,000 income within their first three filings. Lastly, the corporate tax paid by the company is the final one; there are no dividend or capital gain taxes for shareholders to pay. This also applies to international shareholders.

Such rules don’t apply in the US; they have both federal and state income taxes. While the federal income tax is a flat rate of 21%, the state income tax varies from state to state. Additionally, dividends are not part of the corporate income tax, meaning that they’re taxed separately at a rate of 30%. This also includes foreign shareholders, giving an unfavourable outlook for foreign investors looking to explore American companies.

All in all, it can be said that Singapore provides a much better business environment for businesses today. It provides a stable government and economic landscape along with relatively business-friendly laws. If you do decide to incorporate your business in Singapore, choose Lanturn for a hassle-free process.

Lanturn’s Corporate Services

Already have a clear vision for your business? Take the first step towards success by choosing your preferred package and securing your business name with ease. Get started now with our self-checkout tool.

If you’re looking for personalised guidance and expert assistance in your incorporation journey, our dedicated team of specialists is here to support you every step of the way. Lanturn also offers expert accounting and tax solutions to boost your business operations efficiency allowing you to concentrate on growing your business.

Contact us now!